Charge Clients PayPal Fees for Payments sent through WHMCS

Offering multiple payment methods is one of the key to make your web hosting business successful. Customers are busy most of the time that's why you should provide them the comfort they need to buy your hosting plans.

WHMCS makes it fairly easy and quick. Enabling a new payment method takes a few clicks and you can choose from a list that includes PayPal, Stripe, Bank Transfer, Skrill, GoCardLess and many more.

As if it wasn't enough, there are hundreds of additional third-party payment solutions to choose from. For example Payments Bundle adds GestPay, BNL Positivity and Nexi as payment gateways.

Having said that, not all payment methods are equal. The amount of payment fees charged to a merchant depends on various factors. For instance, bank transfers are usually free while payment processors like PayPal charges you high fees.

This directly affects your earnings as the amount of money you receive varies depending on the payment method. This is where things get a bit weird.

Let's suppose you sell a hosting plan that costs 40 euro. Bank transfer always grants you full amount while PayPal keeps 1.75 euro leaving you with 38.25 euro.

That's where people start thinking about charging transaction fees to end-users which brings us to the questions...

Can I Charge PayPal Fees to Customers?

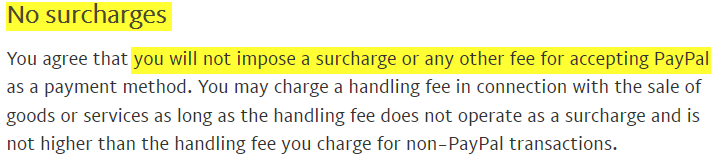

One. PayPal specifically states you can't impose a surcharge or any other fee for accepting payments. This is written in Accepting Payments from Buyers section of User Agreement.

Two. The same prohibition applies to European Union. According to regulations, traders are not allowed to charge extra for using credit or debit card. This includes electronic transactions like PayPal.

Three. National laws may also apply. For example, in Italy it's illegal to impose a surcharge since 2010 as stated in art. 62 Consumer Code. As you probably know, Ryanair was excelling in this habit. Look at them now. We could conclude the question with this image but keep readin.

Over the years, many tried to overcome the problem of high fees with risky subterfuges. I'm going to discuss them in the following chapters. I will also describe how you can legitly reduce the impact of PayPal fees on your business.

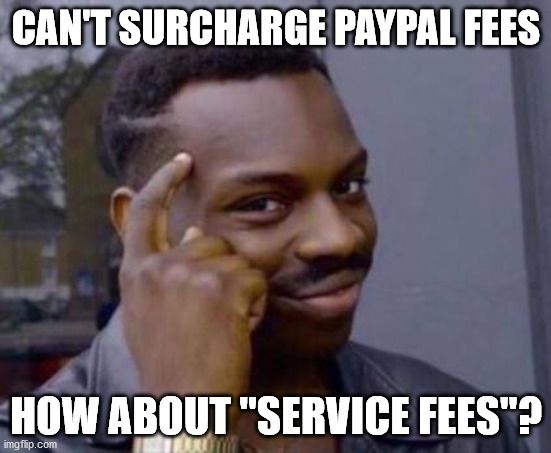

Can I Charge Service Fee?

How many times have you shopped online only to receive an invoice with a strange line item which actually reflects PayPal transaction fee? I'm raising both my hands. This is still a common practice made by "smart" companies people, not to say other words.

Service fees, invoice cost, setup fees, processing fees, you name it. You can't hide behind that excuse. This is still a surcharge and fines are real.

Years ago one of my customers was fined for surcharging customers. It was a 5-figure fine. I know many more companies that are doing it non-stop even before 2010.

As a customer, I'm not the kind of person who sues companies such a thing but for sure I don't this policy. Whenever possible, I look for alternatives. Surcharges are irritating.

Can You Sell the Same Product at Different Prices?

Some WHMCS users go even further transaction fees. They charge a higher price depending on nationality.

EU Regulations impose that purchases without cross-border delivery (eg. hosting, domains) should have access to the same prices as local buyer. Such rules also applies to promotions and special offers.

The only exception are localised versions of a site (eg. Amazon IT, US, DE). In this case one is allowed to charge different prices as end-user can switch to one brand to another.

Just keep in mind that automatic redirection without explicit permission is denied (only if you have web sites with different prices).

Avoiding PayPal Fees

As we said earlier, I know companies that are surcharging end-user from more than a decade. Why is it so rare for infringers to receive warnings from PayPal? Why reporting such activities doesn't turn into account-block? Here's why.

The "No-Waiver" clause is pretty common in User Agreements. In essence, no rights are waived, particularly if the actions of a company like PayPal may suggest that rights are being waived. We use the this same policy even in our EULA.

In a nutshell, the fact that PayPal is not taking actions against infringers of the "No surcharges" rule, doesn't mean this rule is no longer valid. This leads us to the next question: why is PayPal ignoring surcharges even if they are against its own rules?

Many times I tried to get in contact with PayPal asking for explanations. They never replied, which is unusual. They always put the emphasis on how they protect buyers. Why aren't they protecting them when it comes to surcharges?

No one knows why PayPal is so nice towards infringers of this rule but I have a theory. As long as the infringers are sellers, PayPal is safe and can benefit higher profits. Let me explain it better:

- Surcharges lead to more profit for PayPal

- Those who risk fines are sellers

- PayPal can't be sued since their User Agreement inhibit surcharges

Many people dislike PayPal for having high fees but what about their ambiguity on questions like this? Many big companies have been reported for this violation but nothing happened. It's business as usual.

That being said, I advise you not to charge clients PayPal fees for the following reasons:

- You risk getting fined, not PayPal

- From a marketing perspective you don't make a good impression

- In one way or another surcharges are illegal

- No one likes surcharges

How To Reduce PayPal Fees

Here are some techniques that indirectly allows to reduce the impact of PayPal fees on your earnings. Some of these methods can help lowering fees up to 92% but come with compromises.

Issuing Invoices Monthly to Reduce Transactions Fees

WHMCS generates too many invoices. Ordering a service every day of the year will turn into issuing 365 invoices and 365 transactions per year. Every year. Not to mention who knows how many email notifications (eg. invoice created, reminders, payment confirmations).

I designed new monthly invoicing for WHMCS that in one shot reduces invoices, notifications and transaction fees. Based on our case study, here's a comparison between standard WHMCS and monthly invoicing.

| Standard WHMCS | Monthly Invoicing |

|---|---|

| 30.000 invoices | 6.000 invoices (-80%) |

| 120.000 email reminders | 24.000 email reminders (-80%) |

| PayPal fees 46.248 euro | PayPal fees 38.050 euro (-18%) |

With this feature alone, you just saved 8.198 euro in transaction fees. In the same time you have also reduced invoices by 80% that surely lead to more saving reducing the unnecessary costs of invoice processing.

This feature is part of Billing Extension, a WHMCS module that offers also credit notes, Facebook Pixel, electronic invoicing, customer retention and much more.

Avoid Taking Small and Frequent Payments

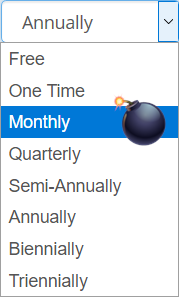

Get rid of monthly billing cycle. There are a lot of benefits to getting paid less often. Speaking of PayPal, the fee for each transaction is 0.35 euro. By opting to be paid less frequently, you avoid some of these fixed fee.

Get rid of monthly billing cycle. There are a lot of benefits to getting paid less often. Speaking of PayPal, the fee for each transaction is 0.35 euro. By opting to be paid less frequently, you avoid some of these fixed fee.

Let's assume you currently run 1.000 hosting plans with monthly billing cycle. At the end of the year they generate 12.000 transactions and consequently 4.200 euro of fixed fees.

Converting billing cycle from monthly to quarterly, translates into 4.000 transactions and just 1.400 euro of fixed fees. With this simple action you saved 67%. You just need to make sure to maintain churn rate as close to 0% and that your business can handle the change in cash flow.

Savings can be even higher if you combine this technique with monthly invoicing. A customer with 4 services that expire in the same month will turn into a single transaction. In other words you pay 0.35 euro instead of 1.4 euro.

Now that you know the benefit of being paid less often, let's repeat the calculations for other billing cycles based on a 12-month period. The table below shows how you can save up to 92% on PayPal fees by moving from monthly to yearly cycle.

| Billing Cycle |

Fixed fees |

|---|---|

| Monthly | 4.200 euro |

| Quarterly | 1.400 euro (-67%) |

| Semi-Annually | 700 euro (-83%) |

| Annually | 350 euro (-92%) |

Using a Limited Number of Payment Methods

Putting all your eggs in one basket can effectively lower processing fees. Let's suppose all payments you receive distributes among payment gateways as follows:

- 10% wire transfer

- 50% PayPal

- 30% credit card

- 10% Bitcoin

PayPal offers enterprise volume discounts that kick off at at 3.000 $ monthly sales. If you are close to this number, you could consider removing one or two payment methods. This way you can redirect payments towards PayPal to unlock discounts.

PayPal Fees Are Tax Deductible

You can deduct PayPal fees on your tax return. Although this won't lower the fees you paid throughout the year, it lowers the income allowing to keep more of your money. People frequently overlook the impact of deducting PayPal fees so let us give you and example.

A company generates a yearly revenue of 40.000 euro as the result of 1.000 transactions. This totals for about 1.710 euro of PayPal fees that represent 4.28% of revenue. That's quite a lot of money. Why should you pay taxes on such amount? Deduct it!

Visit Report section of PayPal and expand Statements menu. You can then proceed downloading your yearly report which is nothing more than a PDF file that includes transaction fees.

Cheap Alternatives to PayPal

No one forces you to stick with PayPal. Yes, it is the most popular online payment in several countries but alternatives exist. Like PayPal, Stripe integrates with in WHMCS in a question of clicks.

As for transaction fees, Stripe could be a better option especially for international merchants.

Apply Surcharges and Hope Nobody Sees You

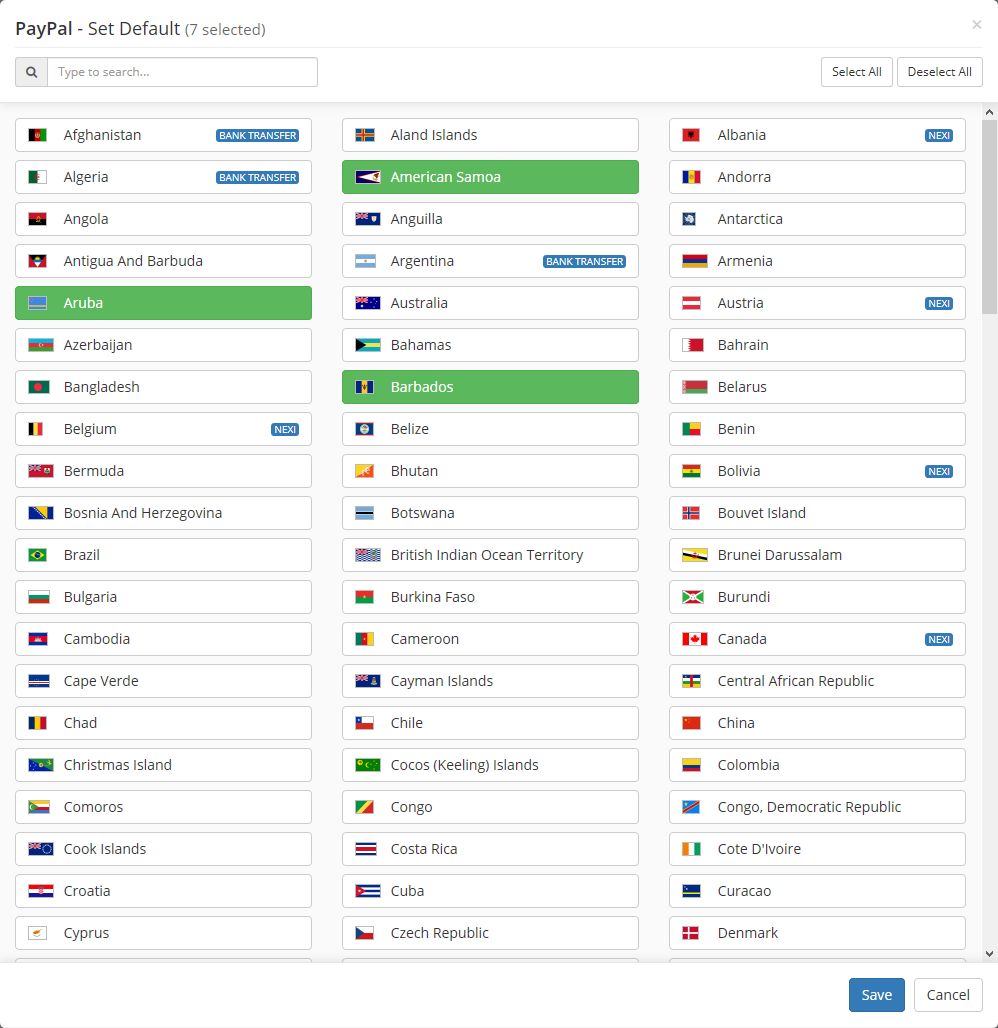

I don't endorse charging clients transactions fees in general but it's a free world. Payment Bundle allows you to do exactly that in WHMCS. Moreover you can also use it to:

- Disallow payment gateways depending on customers' location

- Define default payment methods based on country

- Receive payments with Nexi, BNL Positivity and GestPay

Comments (0)