Australian Taxation System

WHMCS Plugin

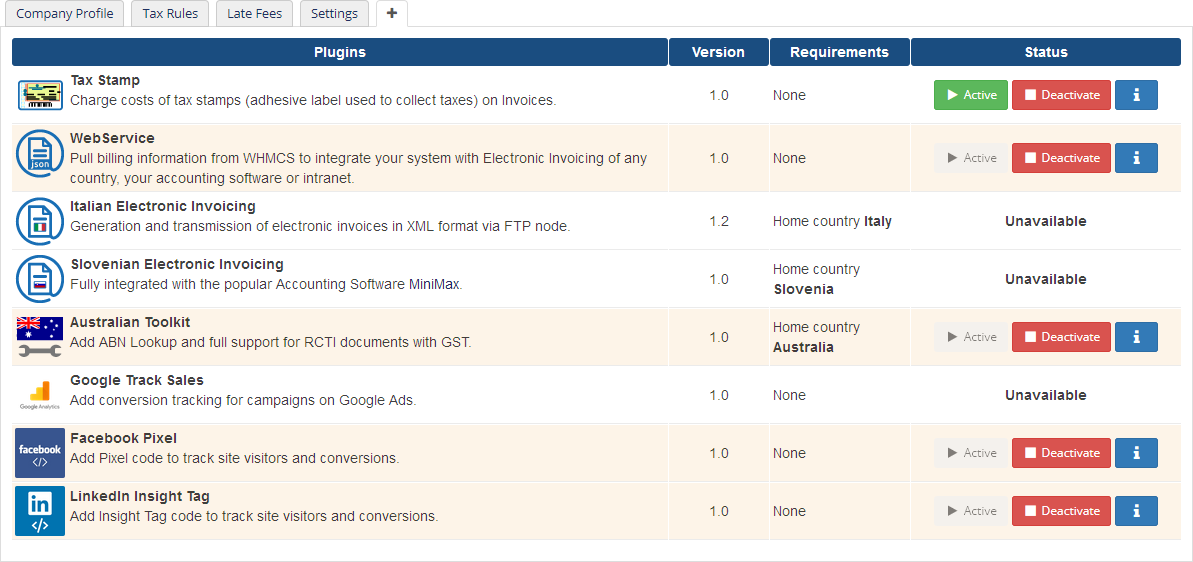

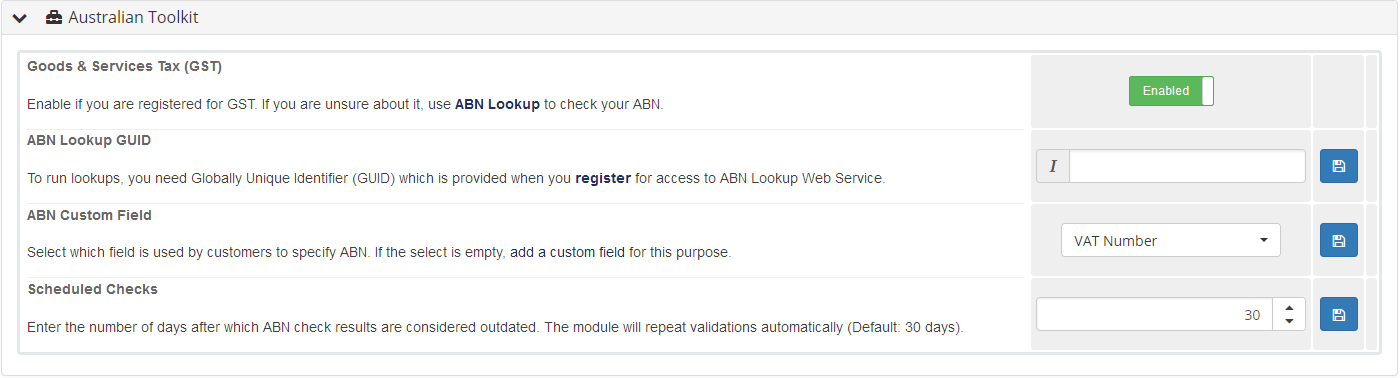

Starting from version 2.2.101 of Billing Extension, the module integrates ABN Lookup functionalities with complete support for RCTI (Recipient Created Tax Invoice) to comply with Australian GST Law. All features are part of Australian Toolkit plugin that can be activated from the following page.

The good news is that both Billing Extension and Australian Toolkit have been integrated with our Commission Manager module. That means you can create your affiliate network awarding commissions to affiliates for spreading the word about you and issue RTCI in line with Australian taxation system.

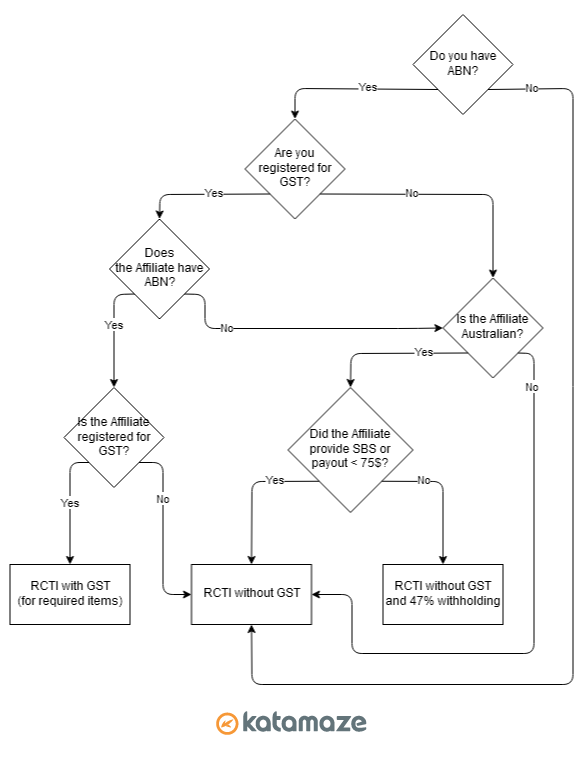

Flowchart

Australia's tax system is one of the most complex of the 20 largest economies in the world. The flowchart below describes the process behind issuing an RCTI to payout an affiliate. Most of the terms like ABN, Statement by Supplier and 47% Witholding are described in next paragraphs.

The image doesn't show all details but we don't want to stress you out with unnecessary explanations. Simply put, Billing Extension works in line with this flowchart respecting all the involved rules.

Side note: if you think that Australia's taxation system is complicated you should try Italy that ranks 3rd as the most complex in the world and Billing Extension supports it! Do you want a taste of it? Click here and scroll the page... this was just for electronic invoicing.

ABN Lookup

| Parameter | Description |

|---|---|

| ABN | Australian Business Number (eg. 76 093 555 992) |

| ABN Status | Can be Active or Cancelled |

| ABN Status Date | ABN validity start date |

| Entity Type | ADF, SUP etc. Full list |

| Entity Description | Approved Deposit Fund, Super Fund etc. Full list |

| Legal Name | Business/Individual name |

| Legal Name Date | Legal name validity start date |

| Address | VIC 3162, VIC 3193 etc. |

| Address Date | Address validity start date |

| ASIC Number | Empty or 093 555 992 format |

| GST | Registered for GST (true or false) |

| GST Date | GST validity start date |

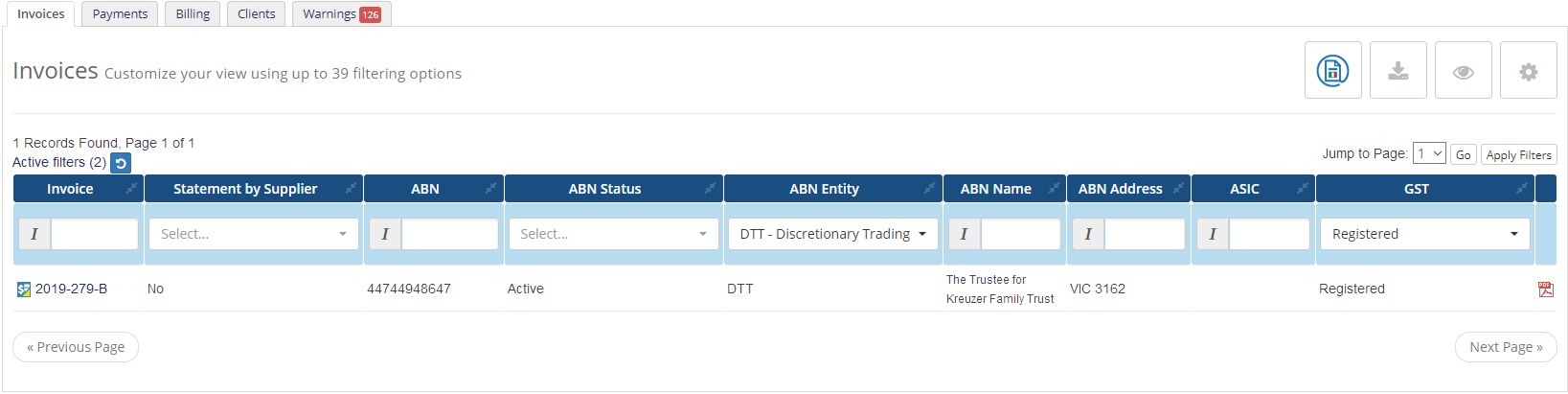

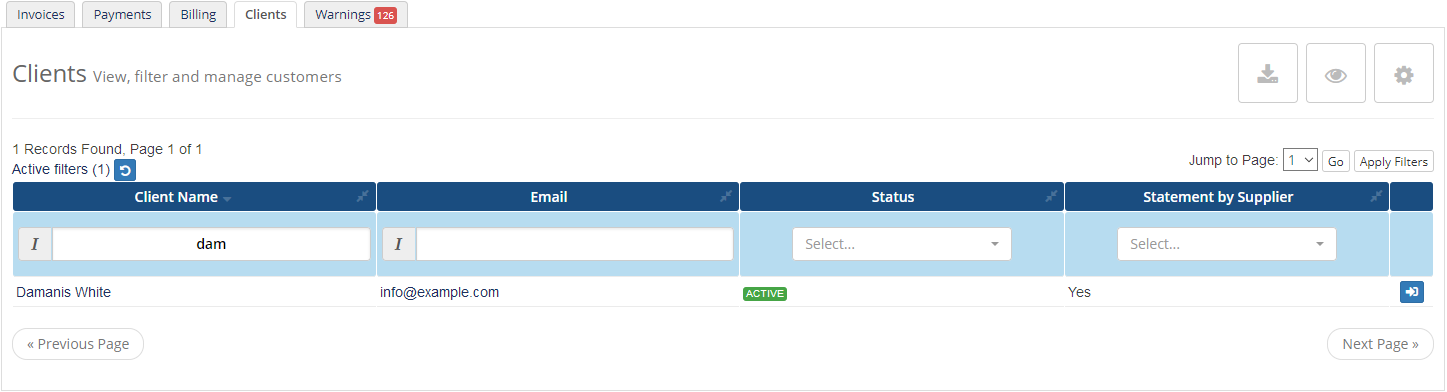

You can easily search and filter ABN parameters from Invoices page. Thanks to SorTables you can add, remove, collapse, move columns and download data on spreadsheet.

Similarly you can review Statement by Supplier status from Clients page (more on that later).

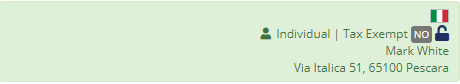

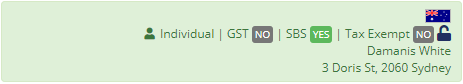

In addition to the above tables, Billing Extension adds panel on client's profile that give you relevant information. Let's start with the basics. The panel below is used for non-Australian customers that don't need any check on ABN hence we have general information and the usual feature used to enable/disable and lock/unlock Tax Exempt status.

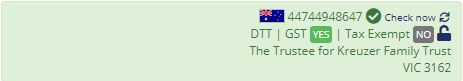

In this case we have an Australian customer (more in particular a DTT - Discretionary Trading Trust) with valid ABN and that is also registered for GST. All details you see directly come from ABN Lookup including business name and address. Pressing Check now performs a new Lookup that may take a few seconds to process.

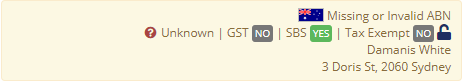

Similarly in the panels below we have a customer with missing or invalid ABN and an individual with no ABN. They both have Statement by Supplier (abbreviated as SBS) that can be enabled and disabled on the fly by simply clicking on Yes/No labels.

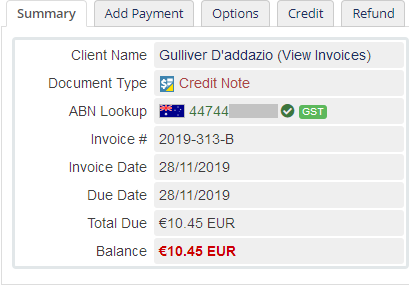

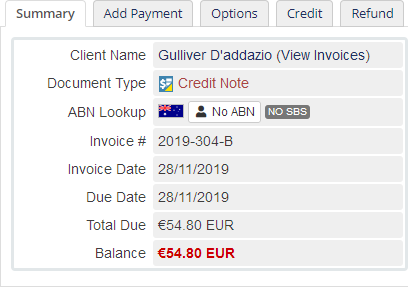

What you just saw can also be found on WHMCS Invoice View when you visit a Credit Note. Below you can find some examples. As we said earlier, ABN parameters are fixed at the time the invoice was generated therfore the change of ABN, GST and SBS on a customer won't reflect on his/her existing invoices.

Statement by Supplier

RCTI issued for clients with SBS include the agreement text WHMCS PDF required by law. You can customize it by overriding the following language variable: $_ADDONLANG['settings']['_plugin_toolkitau']['agreementtext'].

47% Withholding

When you are required to withhold 47%, Billing Extension automatically adds a new line in RCTI with a negative amount that corresponds to 47% of subtotal. GTS-free operation are excluded.

Billing Extension 37

Billing Extension 37

Commission Manager 3

Commission Manager 3

Mercury 8

Mercury 8

Payments Bundle 2

Payments Bundle 2

Comments (0)